The Main Principles Of Estate Planning Attorney

The Main Principles Of Estate Planning Attorney

Blog Article

Get This Report on Estate Planning Attorney

Table of ContentsEstate Planning Attorney for BeginnersAll about Estate Planning AttorneyIndicators on Estate Planning Attorney You Need To KnowThe Ultimate Guide To Estate Planning AttorneyGetting The Estate Planning Attorney To Work

A skilled attorney who recognizes all facets of estate planning can help guarantee customers' wishes are brought out according to their intentions. With the right support from a reliable estate coordinator, people can really feel positive that their plan has actually been created with due care and interest to information. Because of this, people require to spend adequate time in finding the appropriate lawyer that can provide sound guidance throughout the entire process of establishing an estate plan.The records and directions developed throughout the preparation procedure come to be legitimately binding upon the client's death. A competent economic expert, based on the wishes of the departed, will certainly after that begin to disperse trust possessions according to the client's instructions. It is essential to keep in mind that for an estate strategy to be efficient, it has to be appropriately executed after the client's death.

The selected administrator or trustee should guarantee that all possessions are handled according to lawful needs and according to the deceased's dreams. This commonly entails collecting all documents pertaining to accounts, investments, tax records, and other things specified by the estate strategy. In addition, the executor or trustee may require to coordinate with lenders and recipients associated with the distribution of possessions and various other matters referring to settling the estate.

In such conditions, it might be essential for a court to intervene and deal with any disputes prior to last distributions are made from an estate. Eventually, all aspects of an estate need to be worked out successfully and accurately in conformity with existing regulations to ensure that all parties involved receive their reasonable share as planned by their liked one's wishes.

The Estate Planning Attorney PDFs

People need to clearly understand all aspects of their estate plan prior to it is propelled (Estate Planning Attorney). Functioning with a seasoned estate planning lawyer can help make certain the records are appropriately prepared, and all assumptions are fulfilled. Additionally, an attorney can give understanding into just how numerous legal devices can be made use of to secure assets and maximize the transfer of wide range from one generation to one more

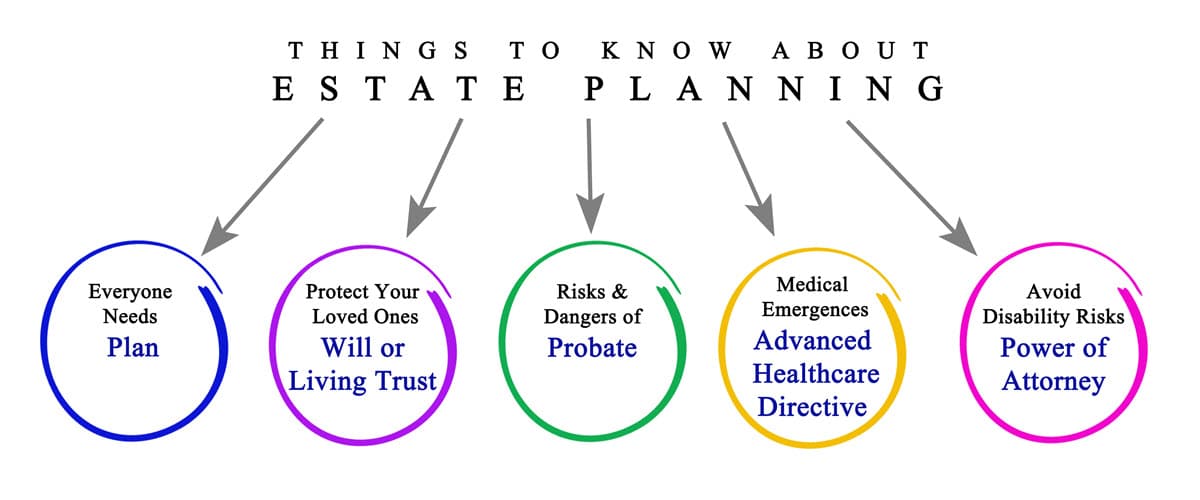

Estate preparing describes the preparation of tasks that manage an individual's economic scenario in the occasion of their incapacitation or death - Estate Planning Attorney. This planning consists of the bequest of possessions to heirs and the settlement of estate taxes and financial obligations, in addition to other considerations like the guardianship of small kids and animals

A few of the steps include listing possessions and financial debts, reviewing accounts, and writing a will certainly. Estate intending jobs include making a will, establishing counts on, making charitable contributions to restrict estate taxes, calling an administrator and beneficiaries, and setting up funeral setups. A will provides instructions regarding building and protection of small youngsters.

Little Known Questions About Estate Planning Attorney.

Estate preparation can and need to be made use of by everyonenot just the ultra-wealthy., handled, and dispersed after fatality., pensions, debt, and more.

Anybody canand shouldconsider estate planning. There are various factors why you may start estate preparation, such as protecting family wealth, supplying for a surviving partner and kids, moneying children's or grandchildren's education, and leaving your legacy for a charitable reason. Composing a will is one of the most vital actions.

Review your pension. This is necessary, especially for accounts that index have recipients connected to them. Keep in mind, any type of accounts with a beneficiary pass directly to them. 5. Review your insurance coverage and annuities. Make certain your recipient info is current and all of your various other information is accurate. 6. Set up joint accounts or transfer of death classifications.

Estate Planning Attorney Things To Know Before You Buy

8. Write your will. Wills don't simply decipher any kind of economic uncertainty, they can also outline strategies for your small youngsters and animals, and you can likewise instruct your estate to make charitable contributions with the funds you leave behind. 9. Testimonial your records. See to it you examine whatever every number of years and make changes whenever you see fit.

Send a duplicate of your will certainly to your administrator. Send out one to the individual that will certainly assume duty for check it out your affairs after you pass away and maintain an additional duplicate somewhere secure.

Rumored Buzz on Estate Planning Attorney

There are tax-advantaged investment automobiles you can benefit from to aid you and others, such as 529 college savings intends for your grandchildren. A will certainly is a legal file that supplies directions about how an individual's residential or commercial property and safekeeping of small children (if any) must be handled after fatality.

Report this page